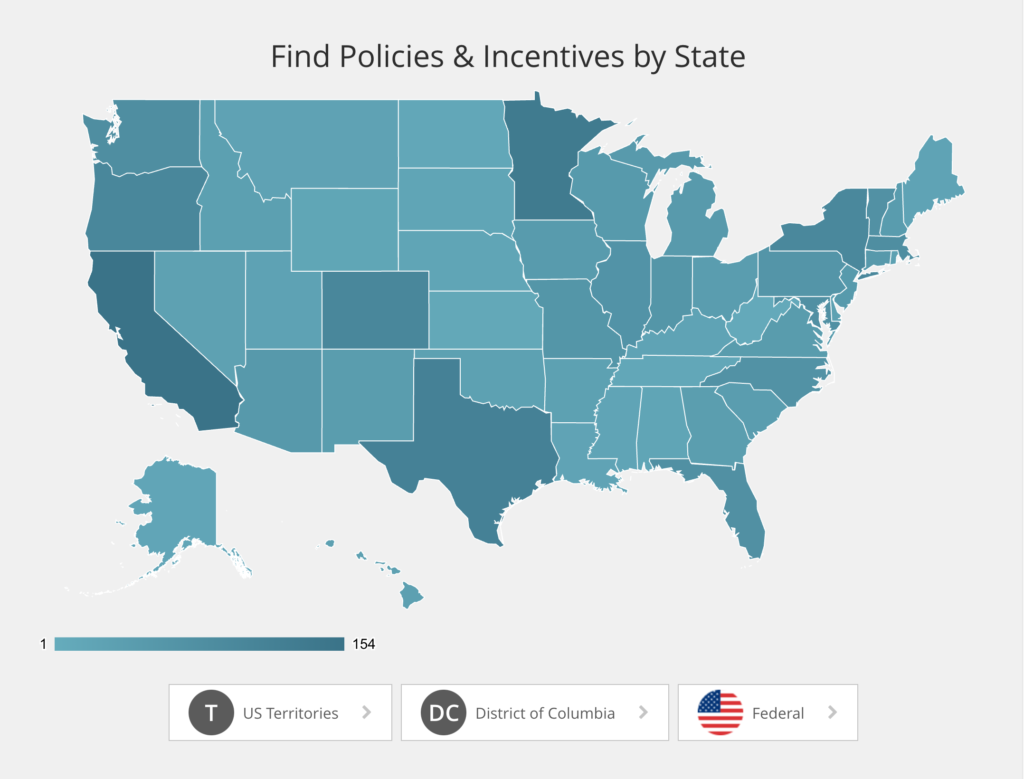

Find Policies & Incentives by State!

Want to learn MORE about specific State & Federal renewable energy policies affecting your region? The North Carolina Clean Energy Technology Center (at NC State University) has developed US-wide tools for tracking such data, and has been doing so for the past 35 years. Many solar sites online use their data to provide myriad resources for clean renewable energy, including solar tech. We thought it would be ideal for you to go straight to the source! Search by state to find the various incentive programs available. Click below to explore more (note: 3rd party external web link.)

Solar Financing Resources*

We know upfront costs for a solar installation can be a deterrent for many. The following financing resources can help you create a powerhouse for yourselves. For a list of national and regional lenders and best practices Click HERE (external link).

Federal Solar Investment Tax Credit (Solar ITC)

The Solar ITC is available to all residents of the United States who owe federal taxes. Under the program, a portion of your solar installation costs can be claimed on your tax return, reducing the amount you owe when you file your federal taxes that year.

Currently the credit is 30% per the Inflation Reduction Act of 2022. This means that, if you install a $19,000 solar energy system, you’ll reduce your federal tax liability by 30%, which is $5,700. If your tax bill is less than $5,700, the remaining credit will be applied to your federal income taxes the following year; you won’t receive the remaining credit as a cash refund.

It’s important to note that as per the Inflation Reduction Act of 2022, the ITC will decrease to 26% in 2033 and further drop to 22% in 2034. It is set to expire completely in 2035 unless Congress chooses to renew it.

Types of Solar Incentives

Solar incentives come in many different forms. Here are a few common programs:

Tax credits

A portion of your project costs can be deducted from your tax obligation, reducing the amount of taxes you pay when you file. In addition to the federal ITC available to all Americans, some states have their own state solar tax credit in place.

Rebates

A partial refund returned to the owner after they buy their system. Typically, this involves buying from a solar vendor, then filing for a rebate with the utility company, local government, or other organization running the rebate program.

Low-Interest Loans

Loans with below-market rates for renewable energy projects. These loans are offered at a reduced interest rate to encourage people to invest in energy-efficient improvements to their home.

Property Tax Relief

In some states, solar systems are exempt from property taxes. The home is assessed as if it did not have a solar power system installed, reducing the homeowner’s tax burden.

SRECs

In participating states, homeowners get credits for the solar power they generate, called SRECs (Solar Renewable Energy Certificates). They can then sell these credits to utility companies through a local marketplace.

Utility companies buy SRECs to satisfy their Renewable Portfolio Standards (RPS), regulations which outline how much of a utility provider’s electricity comes from renewable sources. If they don’t generate enough renewable energy on their own, they can buy SRECs from independent producers to satisfy their solar quota.

An SREC can be worth anywhere from $5 to $450 depending on supply and demand within a local marketplace, so the value of this incentive can fluctuate wildly depending on where you live.

Performance-Based Incentives (PBIs)

A performance-based incentive (PBI) is an incentive that awards a flat-rate payout for every kWh of solar energy generated. PBIs are governed by your net metering agreement with your utility company.

Can I Claim Incentives If I Sign a Solar Lease / PPA?

No. Under solar leases and PPAs, the solar installer owns the system, renting out the power it produces. As the owner of the system, the installer is entitled to claim any available solar incentives for themselves.

Missing out on solar tax credits and incentives puts a major dent in the ROI of your solar panel system. To maximize your energy savings, we recommend buying over leasing if the option is available to you.

content sources:

1) https://unboundsolar.com/solar-information/state-solar-incentives

2) https://www.energysage.com/solar/financing/loan-providers

3) https://www.dsireusa.org/